Grotere foto

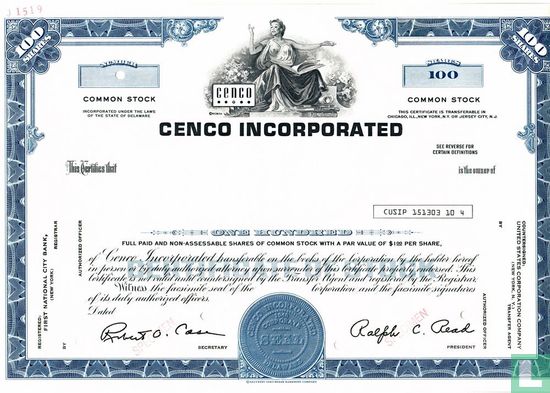

Cenco Incorporated, Certificate for 100 shares, Commopn stock, $ 1,=

Catalogusgegevens

LastDodo nummer

1626565

Rubriek

Waardepapieren

Titel

Cenco Incorporated, Certificate for 100 shares, Commopn stock, $ 1,=

Uitgevende instantie

Soort

Nominale waarde

1,00 US Dollar per aandeel

Rentepercentage (obligatie)

Branche

Land van uitgifte

Plaats van uitgifte

Jaar van uitgifte

Oplage

Decoratieve waarde

Zeldzaamheid

Afmetingen

20,5 x 30,5 cm

Bijzonderheden

Handtekeningen facsimile.

Stuk op naam.

Ontwaarding door perforatie.

Rode stempels "Specimen" over de handtekeningen.

CUSIP 151303 10 4

Cenco Incorporated was founded in September 1948 to acquire the entire stock of Central Scientific Company, which was founded in 1888 as the Central School Supply House. In February 1951 Cenco bought Refinery Supply Company of Tulsa, Oklahoma, and the company name was changed to Cenco Instruments Corporation in November 1957. The name Cenco Incorporated was adopted years later, in 1972.

Cenco manufactured and distributed a wide variety of technologically oriented products and services, such as materials-testing equipment, mobile testing laboratories, laboratory and precision glassware, custom springs, geophysical instruments, and high-vacuum components. In the 1960s Cenco acquired a large number of companies that expanded its technological product base and brought it into the healthcare, pollution abatement, and educational equipment industries.

Between 1970 and 1975, managerial employees of Cenco Incorporated engaged in a massive fraud. The fraud began in Cenco's Medical/Health Division but eventually spread to the top management of Cenco, and by the time it was unmasked the chairman and president of Cenco plus a number of vice-presidents and other top managers were deeply involved. Not all the managers of Cenco were corrupt, however. Seven of the nine members of the board of directors were not in on the fraud, although there is evidence that they were negligent in allowing it to flourish undetected beneath their noses. The fraud was eventually discovered by a newly hired financial officer at Cenco who reported his suspicions to the Securities and Exchange Commission. Cenco's independent auditor throughout the period of the fraud, the accounting partnership of Seidman & Seidman, either never discovered the fraud or if it did failed to report it. The fraud primarily involved the inflating of inventories in the Medical/Health Division far above their actual value. This increased the apparent worth of Cenco and greatly increased the market price of its stock (when the fraud was unmasked, the market price plummeted by more than 75 percent). The inflated stock was used to buy up other companies on the cheap. Cenco further benefited from the fraud by being able to borrow money at lower rates than if its inventories had been honestly stated and by getting its insurers to pay inflated claims for inventory lost or destroyed, since Cenco's insurance claims were based on inflated rather than actual inventory values. Thus, those involved in the fraud were not stealing from the company, as in the usual corporate fraud case, but were instead aggrandizing the company (and themselves) at the expense of outsiders, such as the owners of the companies that Cenco bought with its inflated stock, the banks that loaned Cenco money, and the insurance companies that insured its inventories.