Grotere foto

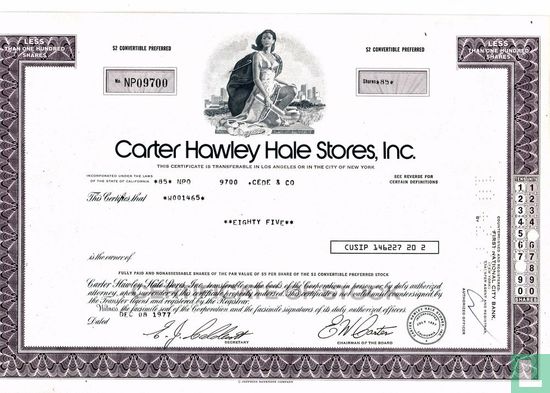

Carter Hawley Hale Stores, Certificate for less than 100 shares, Convertible preferred stock

Catalogusgegevens

LastDodo nummer

1595097

Rubriek

Waardepapieren

Titel

Carter Hawley Hale Stores, Certificate for less than 100 shares, Convertible preferred stock

Uitgevende instantie

Soort

Nominale waarde

2,00 US Dollar per aandeel

Rentepercentage (obligatie)

Branche

Land van uitgifte

Plaats van uitgifte

Jaar van uitgifte

Drukker

Oplage

Decoratieve waarde

Zeldzaamheid

Afmetingen

20,5 x 30,5 cm

Bijzonderheden

Handtekeningen facsimile.

Stuk op naam.

Ontwaarding door perforatie en/of stempeling.

CUSIP 146227 20 2

In 1984, Carter Hawley Hale Stores was the largest retailing chain on the West coast, and sixth largest in the country. Based in Los Angeles, its nationwide empire stretched from trendy LA bargain basements to tiny Fifth Avenue boutiques, with a bookstore chain in between. Operating under the CHH flag were Bergdorf-Goodman, The Broadway, Contempo Casuals, Emporium-Capwell, Hole Renfrew, Neiman-Marcus, Thalimers, Walden Books, John Wanamaker, and Weinstock’s.

The chief executive of this diverse conglomerate since 1973 was Philip M. Hawley. He had led the company on an ambitious acquisition drive, increasing revenue threefold.

Despite the strength of the company’s franchise, however, there was a widespread belief that weak management was dragging down the company’s earnings, reflected in Wall Street’s favorite saying about the company: “God gave them Southern California and they blew it.” Hawley’s acquisition program had resulted in enormous growth in sales, but not in profits. The company’s net earnings had barely grown in the ten years of Hawley’s stewardship.

On two separate occasions, The Limited, Inc. attempted a hostile takeover of the company – but failed each time, finally withdrawing the second offer after the company restructured to fend off the attack.

At first, the employee-shareholders appeared to have made out like bandits. CHH stock reached a peak of nearly $80 during the period following The Limited’s second bid, but by the end of 1987, CHH’s stock had plunged to around $10. Over the next four years the company failed to live up to the projections provided in the 1987 restructuring prospectus. The stock continued on its downward spiral, reaching a low of less than $5 a share in late 1990. The company filed for Chapter 11 bankruptcy protection on February 11, 1991.